As with your choice of a web-hosting company, the payment system you use for your e-commerce site will have a significant impact on the end result. This is not to say that the site will be married to a single payment system for eternity, but as with any divorce, ending a relationship with a payment system can be tedious and costly for your business. Furthermore, it’s possible, if not common, to use more than one payment system at the same time (for example, PayPal and another).

As with your choice of a web-hosting company, the payment system you use for your e-commerce site will have a significant impact on the end result. This is not to say that the site will be married to a single payment system for eternity, but as with any divorce, ending a relationship with a payment system can be tedious and costly for your business. Furthermore, it’s possible, if not common, to use more than one payment system at the same time (for example, PayPal and another).

The payment system is the differentiating element between a standard website and an e-commerce one. The whole point of a payment system is to transfer money between the customers and the business.

In past there were only two broad types of payment systems. These are frequently known by a variety of names but can be described as either a payment processor or a payment gateway.

Note

Some companies, like PayPal, offer more than one type of payment system.

Today a third approach has arisen. For lack of an existing label, I’m going to call this option “the middle way,” for reasons to be explained shortly. I’ll demonstrate an example of each of the three types, but here, I’ll outline their pros and cons.

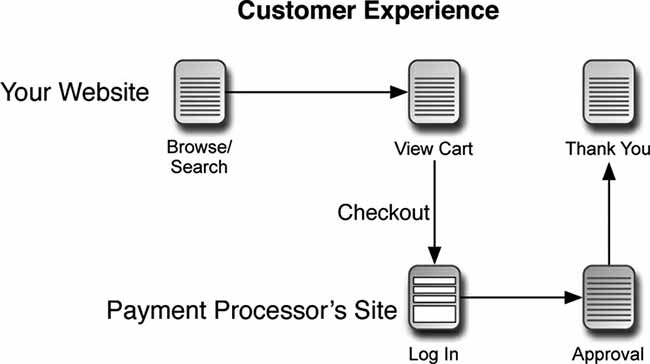

Payment Processors

A payment processor is a delayed payment system that normally goes through a third-party site (Figure 1). The best example is the Payments Standard option at PayPal. If you want to accept payment through PayPal using their basic service, you’ll send the customer to PayPal’s site along with your PayPal identification and some other information. The customer then uses PayPal to authorize the transfer of that amount of money. PayPal (hopefully) returns the customer to your site, and at some later point in time PayPal will make the funds available to you, minus their fees.

Figure 1

Using a payment processor like PayPal Payments Standard or Google’s Checkout may be easy to establish, has little-to-no up-front costs, and taps into a service that many customers will be familiar with (customers are especially comfortable with PayPal). On the other hand, these systems aren’t as integrated into your site as the alternatives, and sending customers away from your site is a risky e-commerce move, increasing the odds of losing the sale. Also, the per-transaction costs tend to be a bit higher, and deposits most likely won’t be automatically made into your business’s bank account (that is, you may need to go into the payment processor’s system in order to accept and then transfer your credits).

I’ll demonstrate how you can integrate PayPal, which is perhaps the most common payment processor, into your site. However, it can be a real chore to work with, even for experienced developers. But I’ll help you navigate that morass in the first e-commerce example in this blog, which I’m calling “Knowledge Is Power.”

Payment Gateways

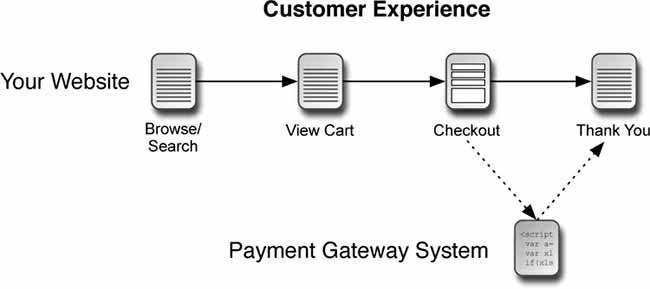

A payment gateway is a real-time payment system that can be directly integrated into your own site, resulting in a process that’s more professional and seamless. Instead of sending users away in the hopes they’ll come back, transaction data is transmitted behind the scenes, and the customer won’t leave your site at any point in the entire process (Figure 2). Also, a gateway offers much better fraud prevention, among other extra features (more on fraud protection in the next section). The gateway will deposit your monies into a merchant account automatically, normally charging less per transaction than payment processors do.

Figure 2

On the other side of the equation, a payment gateway may have higher setup costs and will require more programming to integrate the system into your site. Payment gateways also require a merchant account, which is an account into which credit card charges can be deposited and refunded (for customer returns). You may or may not be able to use your business bank as your merchant account, depending on your bank.

Further, because your site will be temporarily handling the customer’s payment information, you’ll need to maintain PCI compliance. This means more work and more money. PCI compliance will also dictate what hosting options are viable for you: shared hosting, for example, would be unacceptable.

Tons of payment gateways are available. Moreover, some gateway systems are resold through other vendors, giving you the ability to shop around for the best deal. Authorize.net is perhaps the best-known payment gateway.

The Middle Way

Today a new type of payment option has arisen. I have yet to see a label applied to this approach, so I’ll refer to it as “the middle way,” because it offers the best aspects of both traditional models (payment processors and payment gateways).

With the middle way approach, customers enter their payment information on your site, as when using a payment gateway. But the payment information will be directly sent to the payment company (using JavaScript) and never touch your server. This simple difference greatly reduces the steps required for you to be PCI compliant, while simultaneously offering an optimal customer experience. For the developer, the middle way approach is surprisingly simple to set up and integrate. For the business, the fees are competitive, generally comparable to PayPal’s fees, without any monthly or setup fees. And the middle way is a “full-stack” solution, which means you don’t need to find and use a merchant account.

The most popular middle way payment options available at the time of this writing are as follows:

Note

Both PayPal and Authorize.net offer “middle way” solutions as well.

These aren’t perfect solutions, of course. The fees may be higher than other payment options, and there may be a longer delay in getting the money transferred to your bank account than you’d prefer. From a technological perspective, the middle way route tends to require JavaScript. Although only a very small percentage of web users have JavaScript disabled (between 1 and 3 percent), this requirement could be a factor.

In my experience, the biggest negative to these options is that they may not be available yet in your country. These are new approaches, by new companies, and although each company is expanding quickly, they may not be able to service your country quite yet.

New in my blog, I’ll demonstrate how to use Stripe as a payment option. As a disclaimer, as of this writing, I’m employed by Stripe (as a Support Engineer). Although I’m clearly biased toward Stripe, know that I’m working for Stripe because I love what they’re doing, not the other way around. I started using Stripe, and writing about Stripe, long before they hired me.

Which Should You Use?

If I were to start an e-commerce site today, I’d use one of these middle way companies, if available. Obviously I’m biased here, as I work for one of them, but whether or not you use Stripe, I think that the middle way approach offers the best of all the possible pros and cons.

Tip

That being said, many customers prefer to use PayPal, and having more payment options is always better. You might consider using a middle way approach and PayPal.

If you can’t or don’t want to use a middle way approach, you’ll need to select the best traditional payment gateway. When selecting among payment providers, you should first determine if your business bank or web-hosting company has an arrangement with any payment companies. By choosing a preapproved vendor for this important service, you’ll minimize some of the potential headaches and hopefully have an expert to turn to when you need technical support.

Another factor is geography: Different providers will work in your part of the world and will be limited as to what other regions they support. Also, you’ll want to check that the currency the provider uses matches your business’s currency, and that of your customers.

Tip

There are many features to weigh when making your selection:

- Tools for fraud prevention

- Ability to perform recurring billing

- Acceptance of eChecks

- Automatic tax calculation

- Automatic shipping calculation and processing

- Digital content handling

- Integrated shopping cart

Tip

Clearly, many of these features can greatly simplify the development of your e-commerce site and result in a more professional web application, but I’d like to highlight fraud prevention. You may not have given much thought to the subject, but excellent fraud prevention is in the best long-term interest of your site. If someone can use a credit card at your site that isn’t valid or isn’t theirs, you’ll have a false sale and later have some cleanup to perform to undo the transaction. Further, the person whose credit card was fraudulently used will think poorly of your business for allowing the fraud in the first place. For these reasons, using a gateway with sophisticated fraud-prevention tools is a must. The two most common techniques are to verify the billing address and the card verification value (CVV; those numbers on the back of the card).

A final, obvious factor that I didn’t list earlier is cost. You’ll need to consider the initial setup costs, the monthly fees, and the individual transaction expenses. If you require features that come at an extra cost, factor those in as well.

Tip